Top Countries Exporting Auto Parts to the U.S.

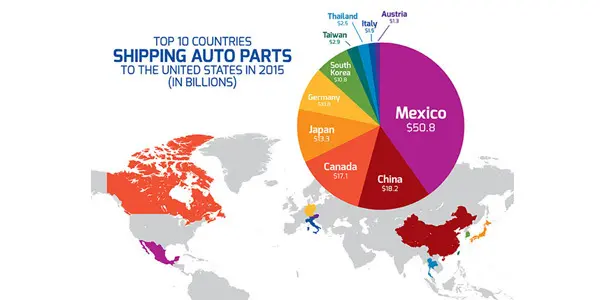

In 2024, the U.S. imports over $150 billion in automotive parts annually, with Mexico, China, and Canada leading as the top suppliers. These three countries account for nearly 60% of all auto parts imports, influencing everything from repair costs to vehicle availability in the American market.

Mexico remains the dominant exporter to the U.S. with $45 billion in parts annually, specializing in wiring harnesses, seats, and steering components. China follows with $32 billion, primarily in electronics and aftermarket parts, while Canada contributes $28 billion in engines and transmissions through integrated North American supply chains.

2024's Top 5 Auto Parts Exporters to the U.S.

1. Mexico ($45B): Wiring harnesses, seating, steering components

2. China ($32B): Electronics, aftermarket parts, aluminum wheels

3. Canada ($28B): Engines, transmissions, suspension components

4. Japan ($12B): Precision components, hybrid systems

5. Germany ($9B): Luxury components, advanced electronics

Key Import Trends Affecting U.S. Consumers

- Nearshoring Growth: Mexican imports up 18% since 2020

- EV Component Shifts: Battery imports from South Korea increased 240%

- Aftermarket Boom: Chinese aftermarket parts now 35% of that market

- Tariff Impacts: Some Chinese parts now 25% more expensive

- Supply Chain Diversification: Vietnam and India emerging as new suppliers

How Import Sources Affect Part Quality & Pricing

OEM vs Aftermarket: Mexican/Candian parts typically OEM, Chinese often aftermarket

Pricing Fluctuations: Currency values create 5-15% price swings annually

Quality Variations: German/Japanese imports have lowest defect rates

Availability Issues: Single-source components create bottlenecks

Warranty Impacts: Some manufacturers restrict non-OEM part use

Key Takeaways

- North American suppliers dominate OEM parts, Asia leads aftermarket

- Import tariffs can add 4-25% to parts costs depending on origin

- EV components are creating new import patterns and suppliers

- Supply chain disruptions continue to affect parts availability

- Country of origin often indicates quality tier and price point

- Professional installers increasingly track parts provenance for warranties